The Battle of the Pension Titans: Why British Columbia Leads Canada’s Retirement Security

A Canadian Comparative Analysis - Article Focus: BC, Alberta, Ontario and Quebec.

Ranking Canada’s Provincial Pension Systems

Canada’s public pension systems operate under distinct governance structures, investment strategies, and funding models. Among the provincial pension funds, British Columbia (BC), Alberta, Ontario, and Quebec have emerged as dominant players, each managing substantial assets and influencing national pension policies. This report evaluates these four provincial pension systems using a comparative approach, analyzing key financial metrics, governance frameworks, investment strategies, and long-term sustainability.

While each province operates pension funds at different scales, this analysis normalizes funded ratios, return performance, and governance structures to provide a fair and accurate comparison. Large asset pools (such as Ontario’s) offer economies of scale, but solvency, governance stability, and risk-adjusted returns are the true determinants of pension system strength. The question is not just who manages the most money—but who does it best.

Based on ten-year financial performance, solvency, and risk management, we assess which province has the strongest pension management model and which has been most effective in weathering the COVID-19 disruption of 2020 and the subsequent recovery.

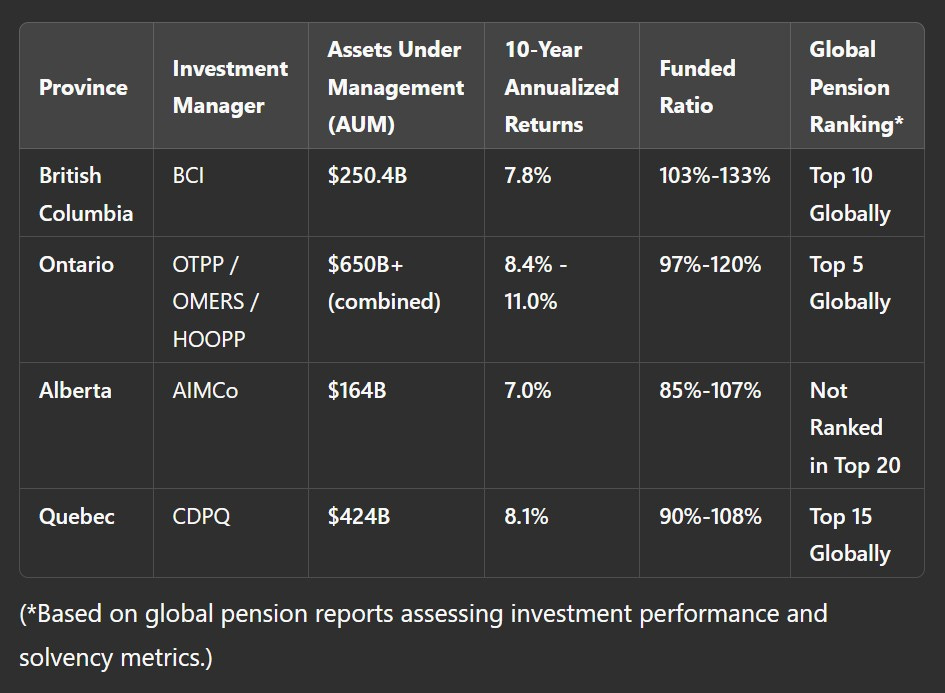

National Overview: How the Provinces Compare

This ranking positions BC’s pension system as the strongest in Canada relative to its size, due to its superior solvency, risk-adjusted returns, and governance model that shields it from political interference—unlike Alberta’s structure. While Ontario boasts larger funds and Quebec has significant financial assets under management, BC’s 103%-133% funded ratio, 7.8% ten-year annualized return, and broad global asset diversification ensure long-term sustainability and fiscal prudence.

Across Canada, BC consistently ranks among the top pension models, standing out against provinces with funding shortfalls or underperforming investment strategies. Ontario remains a formidable competitor due to its scale and investment expertise, while Quebec’s infrastructure-heavy model presents both advantages and risks. Alberta, despite recent improvements, continues to struggle with governance instability. The following sections explore why BC emerges as the most stable and well-managed pension system in Canada.

British Columbia: A Balanced and Sustainable Model

Strengths:

High solvency ratios: BC’s 103%-133% funding ratios ensure surplus assets exceed future liabilities, reducing fiscal risk.

Global investment diversification: BCI manages a broad asset mix, balancing public equities, fixed income, private equity, and real assets such as infrastructure and real estate.

Consistent returns: BC’s 7.8% ten-year annualized return surpasses Alberta’s and aligns with Ontario’s top-tier funds.

Governance stability: BC follows a joint trusteeship model, balancing employer-employee representation and minimizing political interference.

Resilience in downturns: BC avoided major losses during economic crises due to diversified investment strategies and risk-adjusted asset allocations.

Challenges:

Scaling for growth: While BCI has outperformed in risk-adjusted returns, it manages fewer assets than Ontario’s and Quebec’s pension giants, limiting economies of scale.

Ontario: The Pension Powerhouse

Strengths:

Largest asset pool in Canada: Ontario’s pension funds (OTPP, OMERS, HOOPP) collectively manage over $650B, leveraging significant investment advantages.

Global private market dominance: Ontario’s funds excel in direct investments in private equity, infrastructure, and global real estate.

Competitive returns: HOOPP’s 10-year return of 11.0% and OTPP’s long-term average of 9.3% place Ontario at the top of Canadian pension performance rankings.

High professionalization: Ontario’s pension funds are among the most sophisticated globally, employing in-house investment teams and advanced analytics.

Resilience to crises: Ontario funds maintained positive returns in 2020 despite COVID-19, leveraging hedging strategies, rebalancing, and real asset allocations.

Challenges:

Funded ratio concerns: Some Ontario pensions hover around 97%-100% funding, which is lower than BC’s surplus-funded model.

Exposure to market volatility: Higher allocations in private equity and venture capital make Ontario more susceptible to valuation fluctuations.

Quebec: A Strong Contender with Unique Risk Factors

Strengths:

Large asset base: The Caisse de dépôt et placement du Québec (CDPQ) manages $424B, making it one of the largest pension investors in Canada.

Strong returns: Quebec’s CDPQ achieved 8.1% annualized returns over ten years, performing well relative to peers.

Infrastructure investment expertise: CDPQ is a global leader in infrastructure investment, holding major stakes in transportation, utilities, and renewable energy projects.

Challenges:

Solvency concerns: Quebec’s pension plans have funded ratios ranging from 90%-108%, with some struggling to maintain full solvency.

Domestic investment concentration: CDPQ has a mandate to invest heavily in Quebec-based projects, creating geographic concentration risk compared to BC and Ontario’s more global investment approach.

Alberta: A System Under Scrutiny

Strengths:

Growing AUM: AIMCo’s $164B in managed assets has expanded steadily due to Alberta’s energy-driven economy.

Government backing: Alberta’s pensions have strong legislative support, providing stability.

Challenges:

Lower solvency: Alberta’s pension funding ratios (85%-107%) remain among the weakest among Canada’s major funds.

Investment underperformance: AIMCo’s 7.0% ten-year annualized return trails BC, Ontario, and Quebec.

Governance instability: Alberta has experienced political interference in AIMCo’s structure, creating uncertainty.

Liquidity concerns: Alberta’s pension plans have higher exposure to domestic energy markets, limiting diversification potential.

Conclusion: The Best Provincial Pension Model

After evaluating funded ratios, investment performance, governance frameworks, and risk resilience, the ranking is clear:

British Columbia – Balanced governance, fiscal prudence, and resilience in downturns make it the most stable pension model in Canada.

Ontario – Scale and investment expertise give it a strong edge, but lower solvency and volatility present challenges.

Quebec – Large AUM and strong returns make it a formidable player, but domestic concentration risk and solvency gaps limit its ranking.

Alberta – The pension system has improved but remains the weakest among major provinces due to governance instability and underperformance.

BC’s pension model remains Canada’s gold standard for long-term sustainability.